I started this week feeling under the weather. I stayed in bed until lunchtime, moving slower than usual. That night, I had a Zoom session. It was insightful, a quiet reminder that believing in yourself isn’t optional, It’s necessary. Especially in seasons where everything feels a little heavier.

The next day, I had another call. We talked about wealth distribution, something I’ve been genuinely curious about lately. Not in a flashy way. But in a foundational way.

Because the older I get, the more I realize: living intentionally isn’t about doing more. It’s about building better foundations. And that brings me back to something simple.

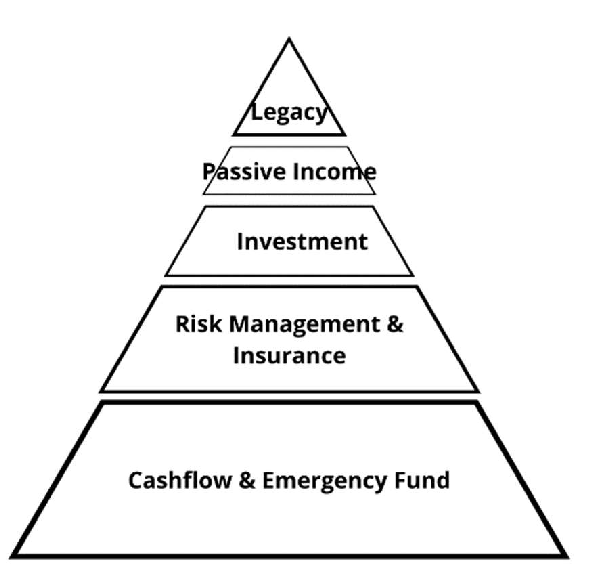

Ini namanya Piramida Finansial. Konsepnya sebenarnya sederhana, tapi sering diabaikan.

Paling bawah: Arus Kas & Dana Darurat.

Ini mencakup pemasukan rutin, dana darurat, likuiditas (rekening, deposito, emas), dan bagaimana kamu mengelola utang. Kalau lapisan ini tidak stabil, semua yang ada di atasnya akan terasa goyah. Investasi sehebat apa pun tidak akan terasa tenang kalau cashflow berantakan.

Di atasnya adalah Manajemen Risiko. Di sinilah peran asuransi.

Beberapa proteksi dasar yang penting dipertimbangkan:

- Asuransi Jiwa: perlindungan finansial untuk keluarga jika terjadi sesuatu pada pencari nafkah.

- Asuransi Penyakit Kritis: memberikan dana tunai (cashout) ketika terdiagnosa penyakit kritis.

- Kalau kamu tinggal di Indonesia, minimal punya BPJS Kesehatan. Kalau ingin fasilitas yang lebih nyaman atau limit pertanggungan lebih besar, Asuransi Kesehatan Swasta bisa dipertimbangkan.

Piramida Finansial sebenarnya terdiri dari beberapa lapisan. Mulai dari arus kas, manajemen risiko, investasi, hingga perencanaan tujuan jangka panjang. Intinya: pondasi dulu, baru naik ke atas. Cashflow dan manajemen risiko adalah safety net. Investasi comes later.

Living intentionally juga berarti sadar bahwa keamanan finansial bukan sesuatu yang “nanti saja”. It’s built layer by layer.

***

At the end of the week, I had a group dinner at Seasonal Taste, The Westin Jakarta. And I met a friend who’s now a mom. Her cute baby sat between us while we talked about life.

There’s something grounding about watching people grow into new roles. New seasons. Motherhood changes priorities. Marriage does too. Even turning a year older shifts what matters. And maybe that’s why the financial pyramid keeps resonating with me. Because every new season requires a stronger foundation.

Living intentionally isn’t about having everything figured out. It’s about building quietly, consistently – so when life shifts, you’re not shaken.

We’ll talk more about Piramida Finansial in the next post. But for now, Week 7 reminded me of this:

Slow down when you need to. Build what matters. Foundation first.

Leave a comment